Know What You Can Expense

Before doing anything else you should become familiar with what counts as an expense. Knowing what is and what isn't a tax deductible expenses might change your buying decisions.

Schedule E

Take a look at the IRS Tax Form Schedule E. This is a common form for landlords to fill out and submit with their taxes. For and explanation of that form take a look at Publication 527 (2019), Residential Rental Property and more specifically the Rental Expenses section.

Listed below are the most common rental expenses.

- Advertising.

- Auto and travel expenses.

- Cleaning and maintenance.

- Commissions.

- Depreciation.

- Insurance.

- Interest (other).

- Legal and other professional fees.

- Local transportation expenses.

- Management fees.

- Mortgage interest paid to banks, etc.

- Points.

- Rental payments.

- Repairs.

- Taxes.

- Utilities.

Ask A Tax Professional

While reading through these tax documents is a very good exercise it might not answer all of your questions. The tax code is very complex and it's a good idea to ask questions and get advice for your specific situation from a tax professional. They might know ways to reduce the amount of taxes you owe that aren't obvious.

Keep Purchases Separate

One of the easiest ways to make expense tracking easier it to not mix personal and business items on the same checkout. When you're at the store needing to pick up a few things for your rental you might want to also grab some things you need at home. There is nothing wrong with that, just remember to keep them separate.

Resist the temptation of a speedy checkout with the plan of figuring it out later. One easy trap to fall into is throwing a last minute candy bar or drink on your purchases because you've been working hard and a snack would be refreshing. Skip it or ring it up separately.

How To Keep Personal and Business Purchases Separate

The best thing to do is to separate your items from the rental items; either in your cart, or at checkout. Ring up one set of items first, get a receipt and then check out again with your other items. You'll probably feel a little weird doing this at first but you'll get used to it.

It is much easier to save and record your rental expenses when you don't have personal items mixed in with them. Doing separate checkouts saves you from having to do the math later.

Use a Separate Bank Account

Some landlords and investors use a completely separate bank account to make purchases for their rental so they know that everything going in and out of that account is related to their rental properties. Some even open separate accounts for each property.

Having a business account for your rentals is a good idea but it doesn't mean you shouldn't work on developing some good bookkeeping habits, that we'll talk about below (and the extra benefits of doing that). A separate account is a popular choice because it's really easy to tell if you're making money or not by seeing if your account is trending up or down over time. However, if you have a lot of purchases or like to pay yourself from that account it can become confusing exactly how well your rentals are performing by only looking at your bank statements.

Keep Properties Separate

More specific expense tracking provides better insights into the performance for each rental. If you use the same account for all of your rentals and your balance increases every month, you might think everything is going just fine. But you might have a rental losing money and the others are doing well enough to cover for it. Keeping good income and expense records will immediately let you know which properties aren't performing well.

If you want to keep more specific records you can make sure to split your purchases by the property, the rental unit, or even individual projects.

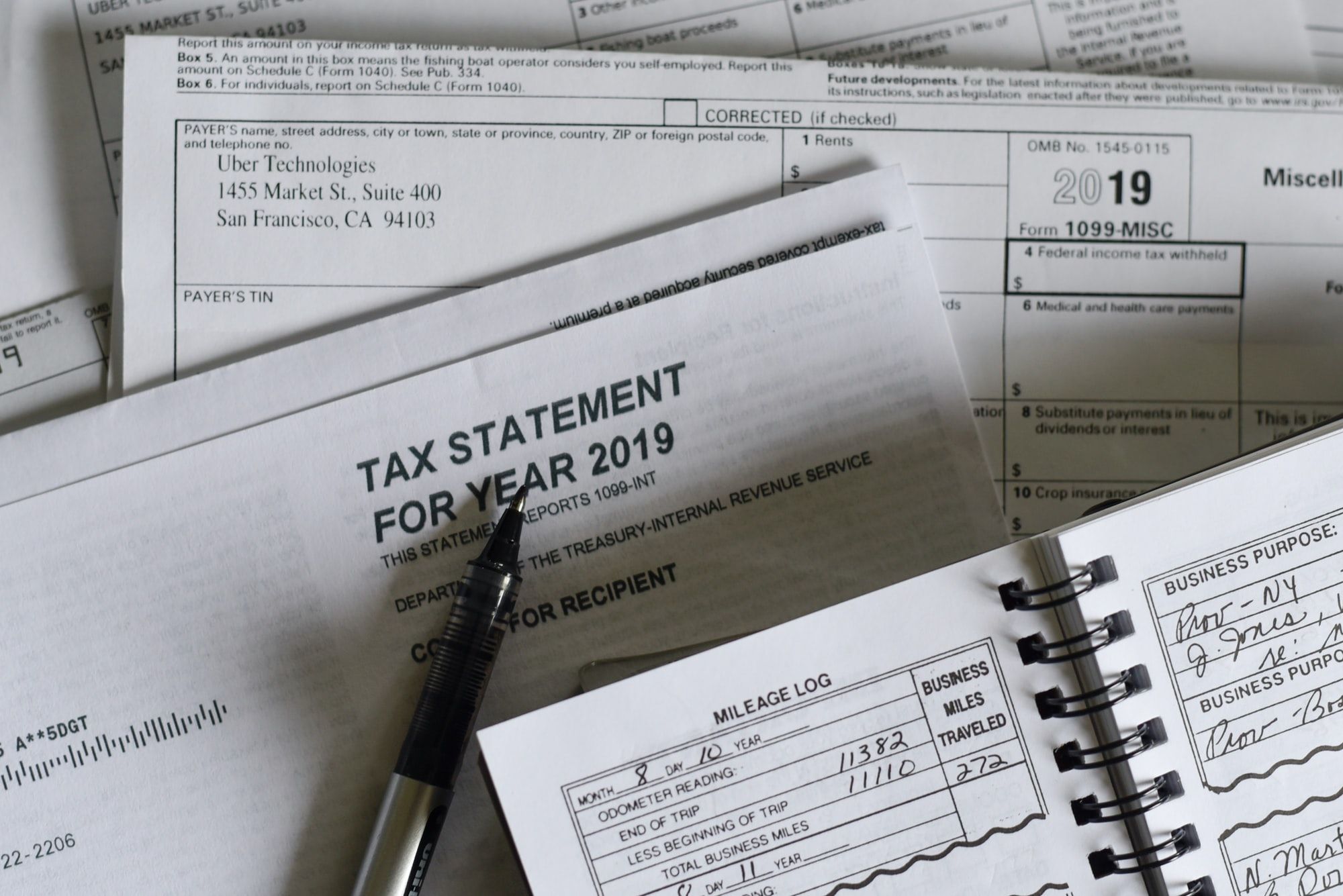

Keep Your Receipts

For taxes you need to have proof of your expenses. Keeping receipts will help you prove that you made the purchases that you are claiming you made.

You also never know when you will need to take something back to the store because you didn't end up needing it or it was damaged when you opened it. Some places won't take an item back without a receipt and others will only give you store credit without one. It's always best to get your cash back instead of having it tied up by another company.

Shoe box

The famous Shoe box method. It's easy to just throw a receipt in a box and plan on sorting it all out later, but that can turn into quite a mess when you have to try to remember what each receipt was for, which could be a month or a year later.

File Folders

Organizing your receipts into folders is a solid idea. This allows you to more quickly find a receipt when you need it. It also makes it easier for you to tally up your expenses at a later date if all the related categories are already sorted.

Digital

There are a lot of advantages to scanning your receipts and keeping them digitally. They take up less space, they are easier to share with somebody, with the right system they could be much easier to find, and there is software that can do most of the data entry for you. I haven't found a great system to do this yet but they are getting better all the time.

Add Notes To Your Receipts

This is a good tip no matter how you end up keeping your expense receipts. When you are at the store, either before walking out the door (ask the cashier for a pen) or when you get to your car, write down a quick note on the receipt that will remind you which property it is for and maybe what project you are working on. You don't need to write the full address, just a number or name that you will easily understand.

These notes can be super helpful later on when you are going through your receipts, especially if you decide to wait to record your expenses. Plus, getting information on paper and out of your head really helps some people be less stressed about trying to remember everything.

Get A Good System

Keeping track of expenses isn't exactly fun so it's imperative that you find a good system that works well for you so you will have good records for when you need them.

Paper Log

Some people prefer writing things down. It helps store the information in their head and gives them a little more time to think about things. You could craft your own expenses log, buy one, or find one online that you can print out.

Spreadsheets

Many landlords and investors use spreadsheets for tracking expenses because the computer can easily, and without error, do the math of summing up the totals. Microsoft's Excel is a powerful classic choice while Google's Sheets is a free alternative with easy collaboration.

Many people start out with a very basic spreadsheet and tweak it as they use it to meet their needs. If you haven't had much experience using spreadsheets you could end up spending a lot of time struggling to get it to do what you want and you have to make sure you don't have any mistakes in your formulas. There are plenty of spreadsheets you can find online that others have created that can get you going quickly and there are also a lot of videos and articles explaining the basic concepts of spreadsheets.

Quickbooks

"Quickbooks is an accounting software package developed and marketed by Intuit. QuickBooks products are geared mainly toward small and medium-sized businesses and offer on-premises accounting applications as well as cloud-based versions that accept business payments, manage and pay bills, and payroll functions." - Wikipedia

Quickbooks is powerful but it has a steeper learning curve and can be difficult to set up for a landlords that just wants to track expenses for their properties. It also requires a decent understanding of accounting. I wouldn't recommend Quickbooks for a new landlord.

Property Management Systems

Most property management systems have basic income and expense tracking that serves most people's needs. With any property management software I recommend you spend some time evaluating it to see how well it will work for you.

For every property management system you are going to find things you don't like and thing you do like. You might feel very limited by some of them. Some just don't work the way that you like to work. It's also hard to switch systems when you have already spent a lot of time setting up and adding data to another one.

GovernRent.com

GovernRent is our product to help landlords and investors track expenses and many other things. As we mentioned above many property management solutions offer basic expense tracking. Quickbooks is on the other end of the spectrum being too complex for most people. GovernRent targets the middle ground with easy setup and more powerful expense tracking features than the free property management software systems out there.

GovernRent's expenses tracking gives landlords the ability to track expenses at a very granular level. You can be very specific about where an expenses happened; a lease term, a project, a unit, a property, and you can even track your business expenses for one or multiple LLCs. Request in an invite to try it out.

Don't Get Behind

Getting behind on tracking your expenses is just going to make your life harder. You can easily forget what an expense was for or you could lose the receipt. Depending on how you do things, it could be confusing what property the expense was for and what tax category it should be applied to.

If you wait until the last minute to figure out your expenses you will likely have to put all of your other tasks on hold until you get everything calculated. It's really hard to estimate how long it's going to take you just by looking at a pile of receipts and paperwork, you could run the risk of not getting everything done by the deadline.

Create A Habit

Our advice is to document your expenses as soon as you can. That might be once a day if you are very active, once a week, or once a month. Whatever your schedule is, waiting until tax time is a very bad idea.

Make It Easy

Using the tactics we've talked about in this article will make tracking expenses easier for you, which will in turn make it easier for you to be successful in tracking your expenses. If you don't separate your purchases, don't keep track of your receipts, and wait until tax time you are making things incredibly hard on yourself and you're likely to make mistakes and miss expenses you incurred.

Know The Value

Keeping good records of your expenses will:

- Help you get the maximum tax benefits.

- Allow you to use them to calculate your rental performance numbers.

- Let you easily look up historical expenses to see how they line up with current ones.

- Help you identify trends in expenses.

- Let you view expenses expressed in different time frames (cost per week, month, year)

- Let you compare expenses between different units and properties.

- Help you identify areas where you can reduce expenses.

- Help you make better decisions for your business.

Keep Expenses In Check

In our busy lives it's easy to let small expenses add up without us realizing how much we are really paying out. When looking at one individual expense it might look totally justifiable, but how much is it costing you over the course of a year? How much are you paying one vender for all your units? How much does it reduce your profits? Good expenses tracking can help you answer these questions in real time and not just when you are preparing your taxes.

-Billy